All Categories

Featured

Table of Contents

Capitalist with an unique legal status An accredited or advanced capitalist is an financier with a special standing under monetary guideline regulations. The interpretation of a recognized capitalist (if any), and the repercussions of being classified because of this, range countries - best investments for non accredited investors. Usually, certified investors include high-net-worth individuals, financial institutions, banks, and various other big firms, that have accessibility to facility and higher-risk financial investments such as equity capital, hedge funds, and angel investments.

It specifies advanced investors so that they can be dealt with as wholesale (rather than retail) clients., a person with a sophisticated financier certificate is a sophisticated financier for the function of Phase 6D, and a wholesale client for the function of Phase 7.

A corporation included abroad whose activities are comparable to those of the firms established out above (accredited investor cryptocurrency). s 5 of the Securities Act (1978) defines an innovative financier in New Zealand for the purposes of subsection (2CC)(a), a person is wealthy if an independent legal accountant certifies, no greater than year prior to the deal is made, that the legal accountant is satisfied on practical premises that the person (a) has net properties of a minimum of $2,000,000; or (b) had an annual gross earnings of at the very least $200,000 for each and every of the last 2 fiscal years

Much more precisely, the term "accredited capitalist" is defined in Policy 501 of Policy D of the U.S. Securities and Exchange Payment (SEC) as: a bank, insurance coverage firm, registered investment firm, business growth company, or little company financial investment business; an employee benefit strategy, within the definition of the Employee Retired Life Income Safety And Security Act, if a bank, insurance provider, or signed up investment adviser makes the financial investment decisions, or if the plan has overall assets over of $5 million; a philanthropic organization, corporation, or collaboration with properties exceeding $5 million; a director, executive policeman, or basic partner of the business offering the securities; a business in which all the equity owners are approved financiers; a natural person that has individual web worth, or joint internet worth with the individual's spouse, that goes beyond $1 million at the time of the purchase, or has possessions under monitoring of $1 million or above, excluding the value of the person's key residence; a natural person with earnings exceeding $200,000 in each of the 2 most recent years or joint income with a spouse surpassing $300,000 for those years and a practical assumption of the very same income degree in the present year a count on with properties over of $5 million, not formed to acquire the safety and securities used, whose acquisitions an advanced individual makes. "Spousal matching" to the certified investor definition, so that spousal equivalents might merge their financial resources for the function of qualifying as accredited financiers. Retrieved 2015-02-28."The New CVM Guidelines (Nos.

How To Become A Investor

17 C.F.R. sec. BAM Capital."Even More Investors Might Obtain Accessibility to Personal Markets.

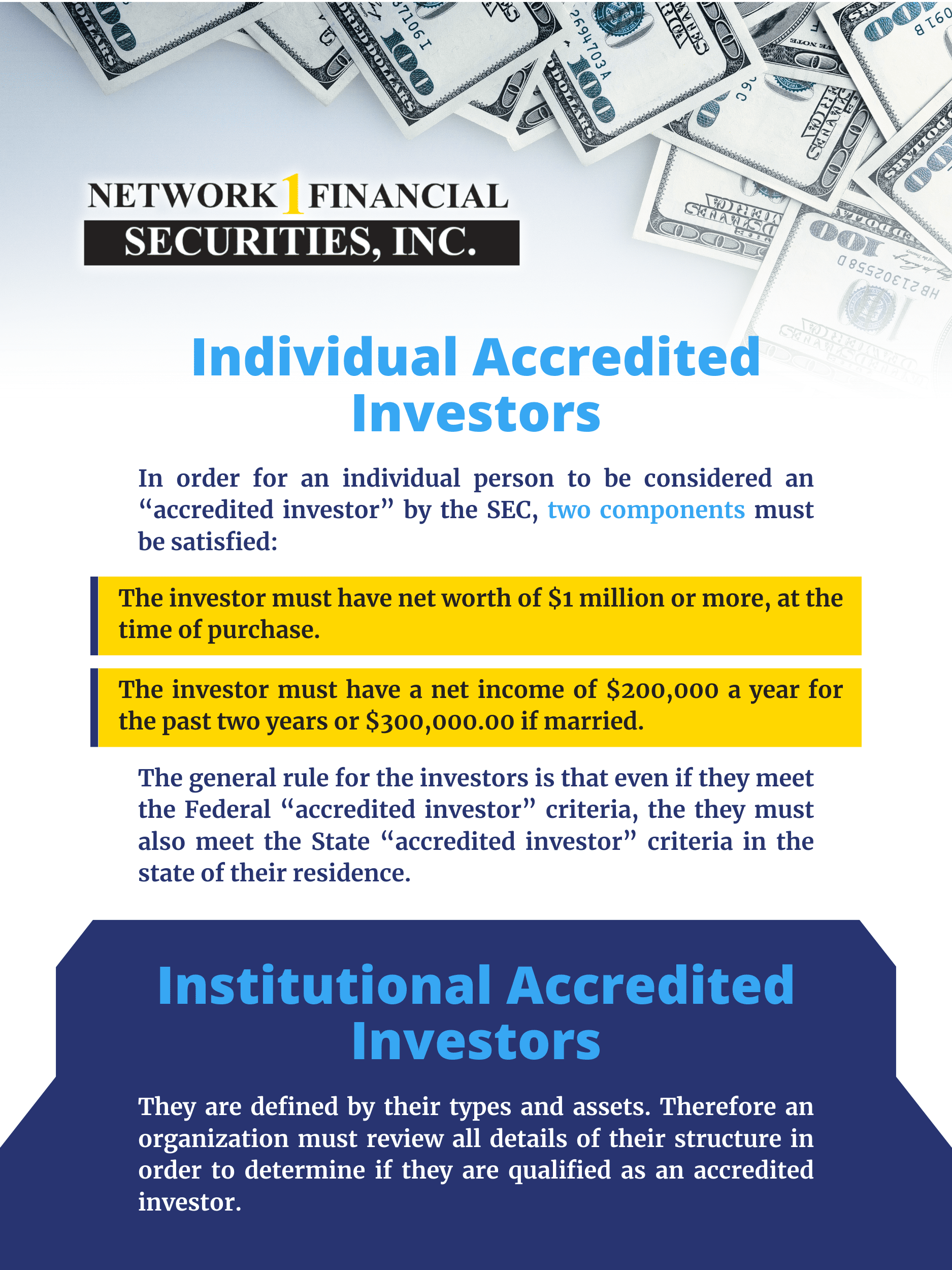

Approved capitalists consist of high-net-worth people, financial institutions, insurer, brokers, and counts on. Approved financiers are defined by the SEC as certified to buy facility or innovative kinds of safety and securities that are not very closely controlled - foreign accredited investor. Particular criteria must be met, such as having an ordinary yearly earnings over $200,000 ($300,000 with a spouse or cohabitant) or operating in the economic market

Unregistered securities are naturally riskier due to the fact that they lack the regular disclosure demands that come with SEC registration. Investopedia/ Katie Kerpel Accredited capitalists have privileged accessibility to pre-IPO companies, equity capital business, hedge funds, angel investments, and various bargains involving facility and higher-risk financial investments and tools. A company that is seeking to raise a round of financing may make a decision to directly come close to certified capitalists.

It is not a public business yet hopes to launch a going public (IPO) in the future. Such a company could determine to use securities to certified financiers directly. This sort of share offering is described as a private positioning. private placement non accredited investor. For recognized capitalists, there is a high capacity for threat or incentive.

Non Accredited Definition

The guidelines for accredited investors differ among territories. In the U.S, the definition of an accredited investor is presented by the SEC in Guideline 501 of Policy D. To be a certified capitalist, a person needs to have a yearly revenue going beyond $200,000 ($300,000 for joint income) for the last two years with the expectation of making the exact same or a higher revenue in the existing year.

A recognized capitalist ought to have a total assets going beyond $1 million, either independently or collectively with a spouse. This quantity can not consist of a primary residence. The SEC additionally considers candidates to be recognized investors if they are general partners, executive officers, or directors of a firm that is providing unregistered safety and securities.

Foreign Accredited Investor

Additionally, if an entity consists of equity owners who are approved capitalists, the entity itself is a certified capitalist. Nonetheless, a company can not be formed with the single objective of buying certain safeties. An individual can certify as a recognized capitalist by demonstrating sufficient education or job experience in the economic sector.

Individuals who wish to be certified financiers do not apply to the SEC for the designation. accredited investor rule 501 of regulation d. Rather, it is the responsibility of the business providing a private positioning to ensure that every one of those approached are approved capitalists. Individuals or celebrations who wish to be recognized investors can come close to the company of the non listed safeties

Accredited Investor Net Worth Requirement

Intend there is an individual whose revenue was $150,000 for the last three years. They reported a key house value of $1 million (with a home loan of $200,000), a vehicle worth $100,000 (with an impressive financing of $50,000), a 401(k) account with $500,000, and a financial savings account with $450,000.

This individual's web well worth is specifically $1 million. Since they meet the internet well worth requirement, they qualify to be a recognized capitalist.

There are a couple of less usual qualifications, such as managing a trust with greater than $5 million in possessions. Under government securities legislations, just those who are approved capitalists may take part in certain safeties offerings. These may consist of shares in personal positionings, structured items, and personal equity or hedge funds, among others.

Table of Contents

Latest Posts

Properties Behind On Taxes

Homes For Sale For Unpaid Taxes

Tax Deed Foreclosure

More

Latest Posts

Properties Behind On Taxes

Homes For Sale For Unpaid Taxes

Tax Deed Foreclosure