All Categories

Featured

Tax Sale Overages Tax Obligation Auction Overages Before the choice by the Court, Michigan was among a minority of states who allowed the retention of surplus benefit from tax-foreclosure sales. Residential or business property proprietors that have in fact lost their building as an outcome of a tax foreclosure sale currently have a claim against the location for the distinction in between the quantity of tax obligation obligations owed and the quantity understood at the tax obligation sale by the Region.

In the past, miss out on tracing was done by debt enthusiast and private investigators to track down people that where staying clear of a financial debt, under examination, or in trouble with the regulations.

Who is required to submit tax overages hands-on pdf? All people who are required to submit a federal revenue tax obligation return are likewise required to file a tax excess handbook (petition for release of excess proceeds texas).

Relying on their filing condition and earnings level, some people may be called for to submit a state revenue tax return as well. The manual can be located on the Irs (IRS) internet site. Exactly how to complete tax excess hands-on pdf? 1. how to buy homes that owe back taxes. Download the appropriate PDF type for filing your taxes.

Following the instructions on the kind, fill out all the areas that are appropriate to your tax obligation situation. When you come to the section on filing for tax excess, make certain to supply all the information needed.

Send the kind to the appropriate tax obligation authority. What is tax obligation overages hands-on pdf? A tax excess manual PDF is a file or guide that supplies details and guidelines on how to discover, accumulate, and claim tax obligation overages.

Property Tax Auction

The excess amount is normally refunded to the owner, and the guidebook offers advice on the procedure and procedures associated with asserting these reimbursements. What is the purpose of tax excess hands-on pdf? The objective of a tax obligation overages hands-on PDF is to give info and advice relevant to tax obligation excess.

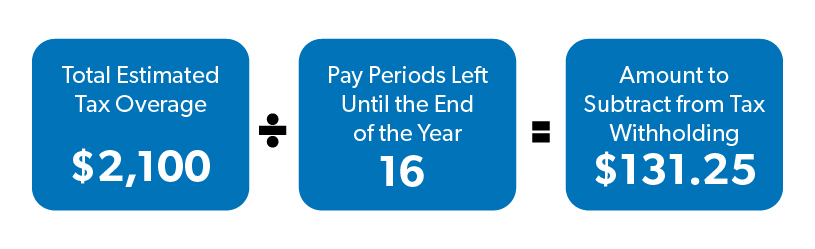

2. Tax obligation Year: The specific year for which the overage is being reported. 3. Quantity of Overpayment: The complete amount of overpayment or excess tax obligation paid by the taxpayer. 4. Resource of Overpayment: The reason or resource of the overpayment, such as excess tax obligation withholding, estimated tax repayments, or any kind of various other relevant source.

Free List Of Tax Lien Properties

Refund Demand: If the taxpayer is requesting a reimbursement of the overpayment, they require to show the quantity to be reimbursed and the preferred technique of refund (e.g., direct down payment, paper check). 6. Supporting Files: Any kind of pertinent supporting papers, such as W-2 forms, 1099 types, or various other tax-related invoices, that confirm the overpayment and justify the reimbursement request.

Trademark and Day: The taxpayer should authorize and date the paper to license the precision of the info given. It is very important to keep in mind that this details is common and may not cover all the certain needs or variants in various regions. Always seek advice from the pertinent tax obligation authorities or speak with a tax obligation professional for exact and updated information regarding tax excess reporting.

Latest Posts

Properties Behind On Taxes

Homes For Sale For Unpaid Taxes

Tax Deed Foreclosure