All Categories

Featured

Table of Contents

You are not being provided any kind of residential property rights. There is a 3 year redemption duration for many properties cost the tax obligation lien sale and throughout that time, the home still comes from the analyzed owner. Extremely few real estate tax liens actually most likely to act. Tax liens not cost the sale are held by the region and are generally readily available for purchase from the treasurer's workplace.

The rate of interest on taxes acquired at the tax obligation lien sale is 9 percent points over the discount rate paid to the Federal Book Bank on September 1st. The rate on your certification will remain the same for as long as you hold that certificate. The rate of return for certifications sold in 2024 will certainly be fourteen percent.

The certificates will be kept in the treasurer's workplace for safekeeping unless otherwise instructed. If the tax obligations for following years end up being overdue, you will certainly be informed around July and provided the chance to recommend the taxes to the certificates that you hold. You will certainly obtain the exact same rate of interest on succeeding tax obligations as on the initial certification.

The redemption duration is three years from the day of the original tax sale. You will certainly obtain a 1099 form showing the amount of redemption rate of interest paid to you, and a copy will also be sent out to the Internal revenue service.

Buying tax liens and acts has the potential to be fairly rewarding. It is likewise possible to purchase tax obligation liens and deeds with much less funding than might be needed for other investments such as rental buildings. This is one of the much more popular investment selections for holders of Self-Directed IRA LLC and Solo 401(k) programs.

Profit By Investing In Tax Liens

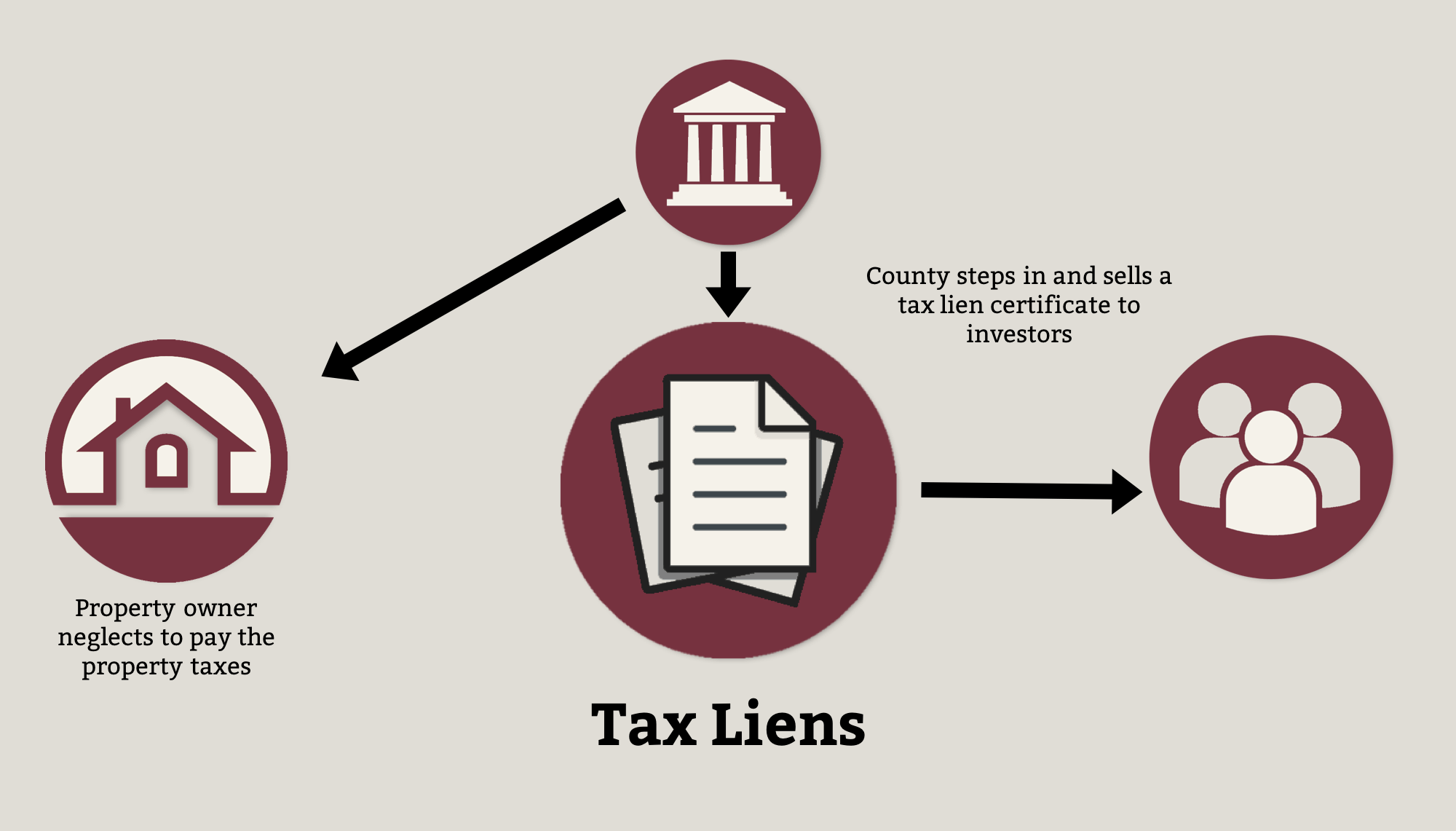

There are two main classes, tax liens and tax acts. A tax lien is issued immediately once they residential or commercial property owner has failed to pay their taxes.

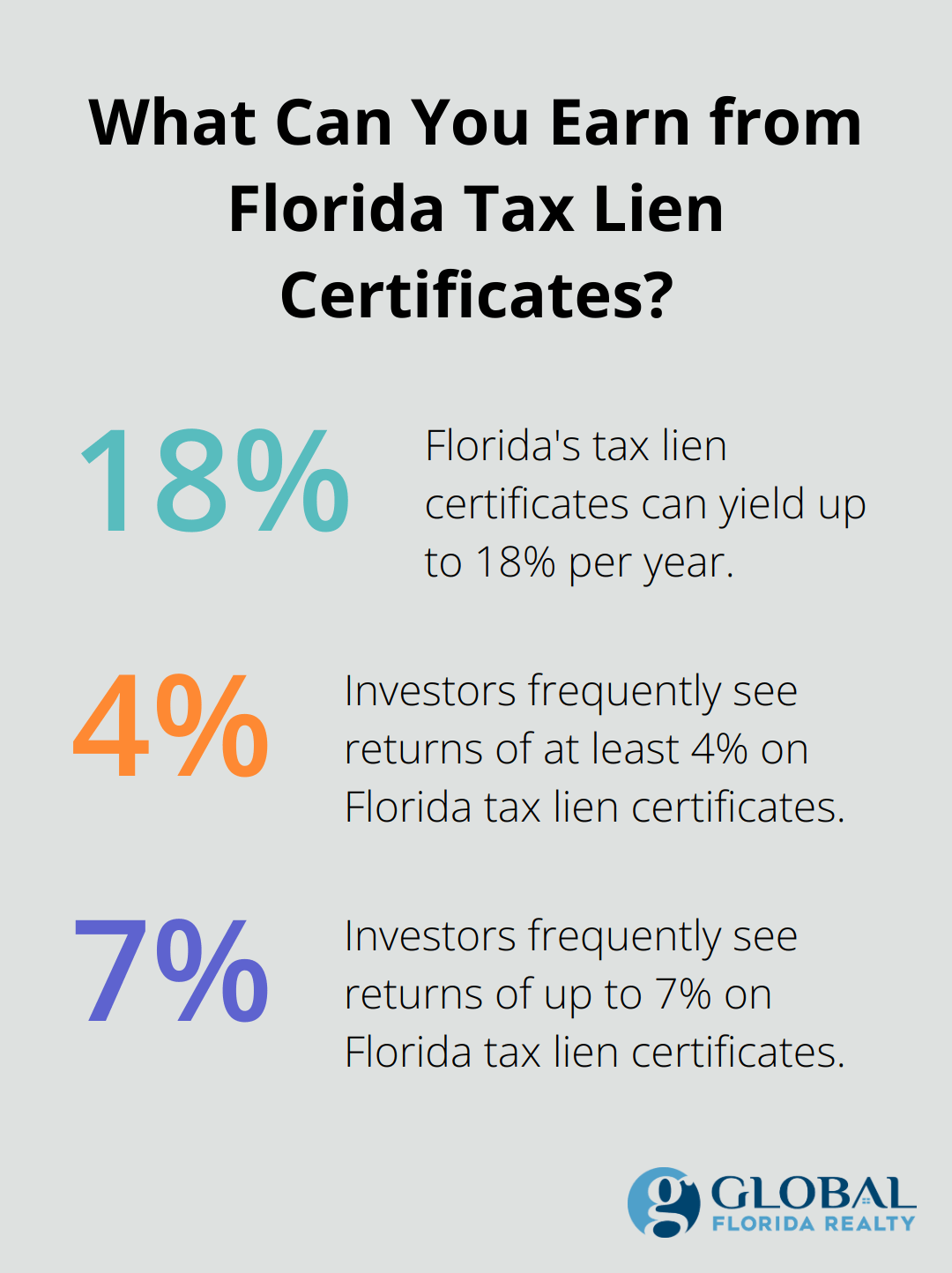

Such liens are then provided for sale to the public. A capitalist purchases the lien, hence giving the community with the needed tax obligation income, and afterwards deserves to the building. If the homeowner pays their tax obligations, the financier typically obtains interest which can be in the variety of 12-18%.

If the residential property is not retrieved, the financier might seize on the property. Tax obligation liens and acts supply the possibility for charitable return on investment, possibly with reduced amounts of funding. While there are particular threat elements, they are relatively low. Tax lien investing is concentrated on the collection of rate of interest and penalties (where readily available) for the tax debt.

The process for spending varies by state and by region. Most liens and deeds are sold at auction, with some auctions taking area in-person at a region courthouse, and some occurring online. You will generally need to register in breakthrough for such public auctions and might be required to put a down payment to get involved.

Tax Lien Investing Books

In some territories, unsold liens or acts might be available up for sale "over the counter" from the area clerk's office or web site after a public auction has been completed. Before joining an auction, you will certainly wish to carry out study to identify those buildings you might want and make certain there are no difficulties such as other liens that may require to be resolved or troubles with the building itself that may produce concerns if you were to take over ownership.

This duration is suggested to provide the residential or commercial property owner a possibility to settle their financial debt with the tiring authority. With a lien, redemption indicates that your Individual retirement account or 401(k) will get a cash advance, with passion and any kind of applicable fines being paid.

Tax lien and act investing is an area where checkbook control is a must. You need to be able to provide funds directly on brief notice, both for a down payment which must be signed up in the plan entity name, and if you are the winning bidder.

If you make a down payment and are not successful in bidding process at public auction, the down payment can simply be returned to the plan account without hassle. The several days refining delay that features functioning straight via a self-directed individual retirement account custodian just does not operate in this space. When purchasing tax obligation liens and actions, you need to make certain that all tasks are carried out under the umbrella of your strategy.

All expenditures connected with tax lien investing should come from the strategy account straight, as all revenue created must be deposited to the strategy account. tax lien investing in canada. We are commonly asked if the plan can pay for the account owner to attend a tax lien training class, and advise against that. Even if your investing activities will certainly be 100% via your plan and not entail any type of personal investing in tax liens, the internal revenue service might consider this self-dealing

Is Investing In Tax Liens A Good Idea

This would certainly also hold true of getting a building by means of a tax action and then holding that residential property as a rental. If your approach will certainly involve acquiring homes merely to reverse and resell those residential or commercial properties with or without rehab that could be checked out as a dealer activity. If performed often, this would expose the individual retirement account or Solo 401(k) to UBIT.

As with any investment, there is danger related to purchasing tax liens and deeds. Financiers must have the financial experience to determine and recognize the threats, carry out the required diligence, and appropriately carry out such financial investments in compliance internal revenue service guidelines. Protect Advisors, LLC is not an investment advisor or carrier, and does not recommend any kind of details investment.

The information over is academic in nature, and is not meant to be, neither must it be interpreted as supplying tax obligation, legal or investment guidance.

Tax Lien Investing North Carolina

6321. LIEN FOR TAX OBLIGATIONS. If any type of individual liable to pay any tax obligation overlooks or rejects to pay the same after demand, the amount (consisting of any type of rate of interest, added quantity, addition to tax, or assessable fine, with each other with any kind of expenses that might accumulate in enhancement thereto) shall be a lien in support of the United States upon all building and legal rights to home, whether real or individual, belonging to such person.

Tax Lien Investing Ny

Department of the Treasury). Generally, the "individual reliant pay any type of tax" defined in section 6321 has to pay the tax within ten days of the created notification and demand. If the taxpayer fails to pay the tax obligation within the ten-day period, the tax lien occurs immediately (i.e., by operation of regulation), and is effective retroactively to (i.e., occurs at) the day of the analysis, despite the fact that the ten-day duration always ends after the assessment day.

A government tax lien occurring by regulation as described above stands against the taxpayer with no more action by the federal government. The basic rule is that where 2 or even more lenders have completing liens versus the same home, the creditor whose lien was perfected at the earlier time takes concern over the creditor whose lien was perfected at a later time (there are exceptions to this rule).

Table of Contents

Latest Posts

Properties Behind On Taxes

Homes For Sale For Unpaid Taxes

Tax Deed Foreclosure

More

Latest Posts

Properties Behind On Taxes

Homes For Sale For Unpaid Taxes

Tax Deed Foreclosure